The Reluctant Property Investor (published in July 2014)

Niraj Shah, a relative newcomer to property investment talks with the PIN editor Richard Bowser

first met up with Niraj Shah at a London property event, just under three years ago. At that point he had yet to purchase any investment property but since then he has made some very positive investments and is now doing some decent sized development projects.

I asked Niraj about his career experience prior to our first meeting in 2012.

"I spent nearly 10 years in the recruitment industry," he replies, "mostly headhunting mid to senior traders on behalf of global investment banks, whilst investing in stocks and shares in my spare time. Recruitment taught me all about creating revenue from scratch, business ethics (I was lucky to mostly work for firms who had them!), managing people and building businesses. I also transacted a lot of business in Asia, travelling there regularly and living in Hong Kong for a while. It was very lucrative and fun work."

What sort of funds did you start out with?

"My investment experience started in 1998 with £1,000 left from my first year university student loan, which I invested in shares. Over the 16 years since I've constantly added more funds and returns to that pot, made some mistakes and learned how to successfully invest. Now I hold strong investments in a handful of businesses and occasionally put capital into a high growth firm or start-up."

When did you obtain your first property?

"In 2006 my wife and I bought a run- down flat in a very affluent part of London. Our logic was to create value by extensively refurbishing it and to live in a place which was to our personal liking. Buying and refurbishing it whilst we worked very long hours, travelled a lot and knew nothing about property was a fairly stressful experience! This was my only experience in property until 2012.

In 2010 I had made a firm decision to leave the corporate world to start a business and circumstances quickly conspired to create that opportunity. Over the next 18 months I worked in a couple of early stage technology businesses to learn whilst trying out some ideas of my own. I became very frustrated because I had worked extremely hard but failed to get any tangible results to show for it.

"I had no interest in property but turned to it at the start of 2012 firstly because we needed to get started with property investments and secondly after analysing the sector it became clear that it was an incredibly sensible area to focus on. It was a calculated move but one borne out of deep frustration and desperation - I had to make it work or go back to corporate life."

What happened next?

"I was quite open- minded about what to do in property, and explored ideas like opening an estate agency or starting a property technology business amongst others.

I started immersing myself in the sector by meeting everyone I knew in property and devouring every property book that I could get my hands on. A lot of people told me that although they had done well in property it was not a good environment to start.

I then met with a childhood friend, Tushar Shah, who had built a great portfolio with a high level of cashflow in just two years. Naturally I was curious as to how he had done it when so many others were telling me that the recessionary environment at that time made it impossible to succeed.

Tushar had done a comprehensive property course and this was the first time I'd heard about a property education industry! I meticulously researched the main offerings and decided that whilst a big investment, Simon Zutshi's course would give me faster access to experienced people and help me progress more rapidly with less mistakes.

From March to May 2012 I researched all of the main strategies whilst simultaneously seeking out and building relationships with great solicitors, brokers, accountants and other investors. I worked out what I should focus on and where to invest based on my desired outcomes and resources."

Where did you decide to invest?

"After some deliberation I chose to build an Inner London based portfolio of high-end houses of multiple occupation (HMOs) to create recurring cashflow that didn't require on- going hard work to keep.

I didn't find the idea of building a HMO portfolio very appealing in itself, but I wanted to own the assets. The only area that actually interested me in property was 'development'. To me that's the process of owning or controlling a property, adding huge value to it and then exiting my initial cash outlay through a sale or refinance."

Choosing an HMO as ones first investment property is not what too many people do as the management side can be quite demanding, so I asked Niraj what made him choose this approach and why did he pick the ones he did?

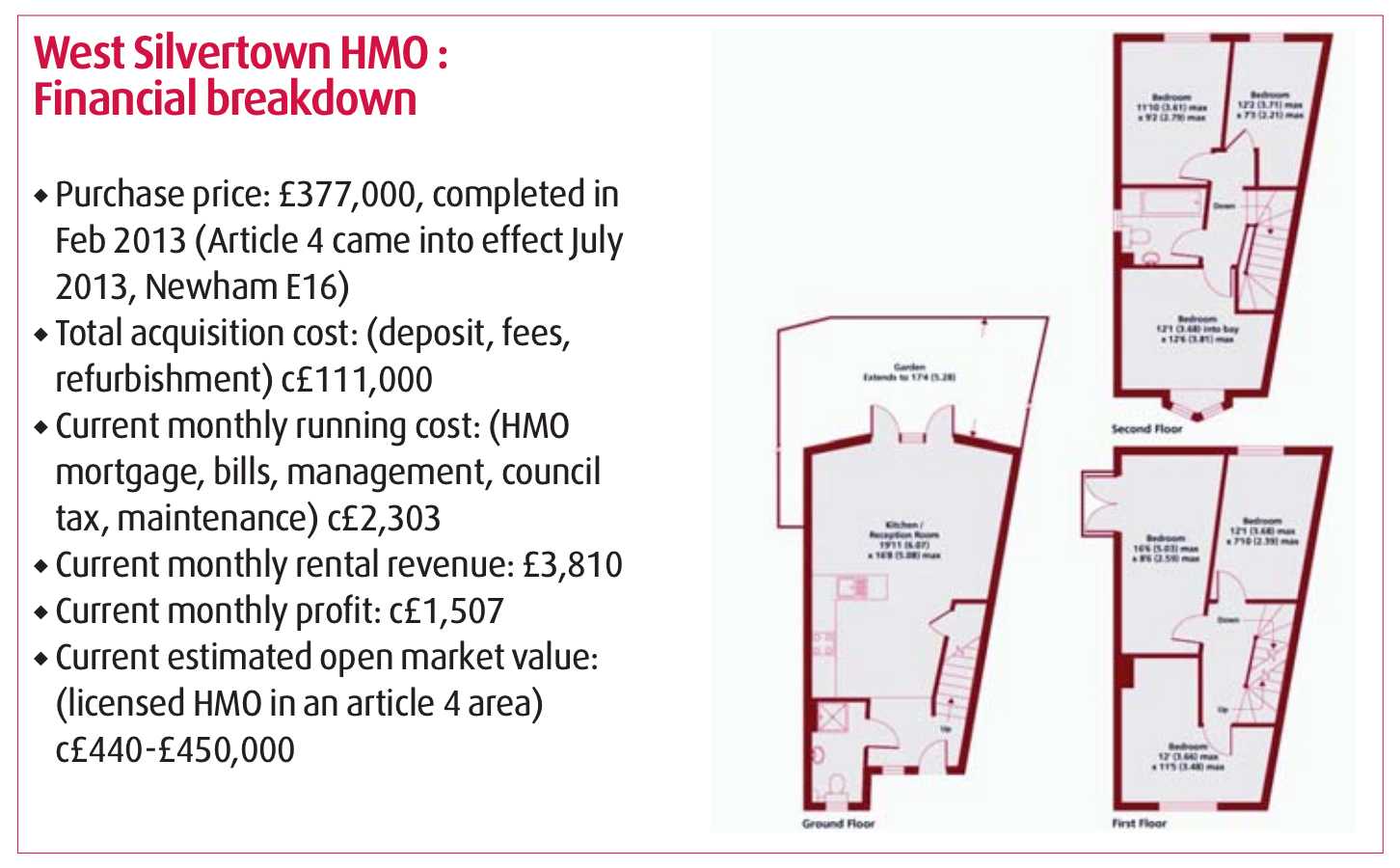

"I became very clear on a model that I thought would work, targeting properties within a 20 minute door-to-door commuting time of Canary Wharf, east London in which I could create 5 to 6 rooms netting a monthly profit per property of £1,500+ after all costs including voids, maintenance and management.

There was much more to it than that of course, but those were the basic criteria. I got a very detailed understanding of what would work and was regularly walking the streets to really get familiar with the local areas; this is a key factor in London where rental and sale values can vary dramatically from street to street and property type to property type."

Can you explain just why you chose the Canary Wharf area?

Niraj continued: "The cash flow forecasts for my model were strong and there was huge large-scale infrastructure improvements and regeneration happening in those areas, which bodes well for the longer-term asset values.

I particularly targeted Newham E16 knowing that Article 4 legislation that would require planning permission for HMOs was coming soon. As an experienced investor but at that time of course not in property, I really couldn't believe others were shying away from a product whose supply growth was about to be dramatically reduced whilst long-term demand for high quality rooms in shared houses was clearly rising.

Those first couple of multi-lets have proved to be tremendous buys for the cashflow alone, never mind the dramatic capital appreciation which I won't even think about until it I refinance the properties next year."

I asked Niraj about the lessons he learnt from those HMO properties.

"Once I had a very clear idea of what would work for me," he replies, "my best decision was deciding the worst-case return I would accept for the first deal and as soon as that deal appeared I jumped on it.

Moving quickly was critical - I got the phone call offering the deal on a Thursday whilst in New York. If I'd waited until I returned on Monday I knew the deal would be gone so I researched, negotiated and closed it within 24 hours through the help of a trusted fellow investor viewing it for me and then sending me pictures and his report. With less clarity and hunger I would have lost that deal.

My advice to newcomers is to get clear on what the worst deal they are willing to do is and as soon as that deal comes along, then just do it. To be clear I would not advise anyone to do a bad deal, simply to be very clear about what the worst-case return they're willing to accept is.

My priority was cashflow but my interest was in property development. I wanted to focus mainly on one thing, so I spent 80% of my time on HMOs and 20% on finding developers to work with.

I found a couple of great experienced developers and brought a combination of capital, time and resources to them in return for a small slice of a deal, and more importantly the chance to spend time with them to learn as much as possible. This was a great move as it helped me do better refurbishments on my HMOs as well as learn the mechanics of the deals I wanted to go on to do myself."

And with hindsight what might have you done differently?

"In terms of doing things differently there's not that much I would change. I've worked very hard, with focus and strong reasons to make this work. It took a few months to accept that transactions take time and the property sector does not move as fast as I want it to move.

In hindsight I really wish I had got into property many years earlier. I just had no interest in it before; I thought it was a boring sector but I didn't know just how interesting it could be.

There is huge fulfilment in providing people with a quality home that is the best they can find in their budget and there is almost as much satisfaction in watching the rents roll in month after month without needing to keep working for them!"

What's your current plan for progressing your property ventures?

"My HMO portfolio is now very systemised and it is managed by an outstanding property manager who took me a long time to find. I have no plans to grow it in the short term but if I see another property asset that fits our model then I'll buy it."

I ask Niraj what's he been doing this year.

"Since the start of 2014 my focus has been to build my property development business, Indus Valley Property. We have our first deals underway, which include a great refurbishment project in Hammersmith with a GDV of £700k+ and a couple more projects that are close to exchange but I don't like to talk about deals publicly until I've locked them in. The plan is to keep growing each subsequent deal's value with the goal of operating in the +£2m space in a few deals time.

I'm still doing joint ventures with developers transacting larger deals; I've found and structured seed capital for a couple of projects in East London with gross development values (GDVs) of £3m to £7m, which has resulted in me getting a financial interest in and exposure to some great projects and amazing people. I'm making good money doing it and it's accelerating my growth. However I'm acutely aware that I have an incredible amount to still learn."

What mistakes do you see some investors making that you have met and what should they consider changing in order to succeed?

"In the current climate it seems many people in the South East are literally gambling on asset price growth," replies Niraj. "That is neither investing nor smart and it could get quite ugly when the tide of sentiment turns. It scares me that there are people chasing sizeable and complicated property deals such as office to residential conversions or new-build projects when they haven't even done a small investment or refurbishment project.

Right now I regularly see people waste time, energy and sadly significant amounts of money on projects with scarily low profit margins because they haven't learned how to appraise deals but get seduced by a potential profit that is inevitably inflated and often linked to perceived asset price growth.

Worse still is buying land with the hope of getting planning permission, then speaking to a specialist planning consultant for the first time afterwards!

I still don't have a huge interest in HMOs but what I learned about so many facets of property whilst doing those smaller £300k to £400k deals has been invaluable learning for my now larger deals.

As a more general point I think it's very important to focus. First decide what outcomes you're looking to create and then find people that are already successfully doing it - that proves it's possible. After that I think it comes down to hunger, drive, persistence and not getting distracted.

Personally my peer and mentor group has been hugely important in terms of advice, knowledge, belief and attitude. A handful of people including Simon Zutshi, Vanish Patel, Steve Marshall, Martin Skinner and Paul Higgs have had a massive influence on me and I couldn't have got this far so quickly without their counsel. Everything I've done in property has been based on building the right relationships.

Ultimately serious property investment and development is not a game for amateurs or dabblers, it's a capital-intensive business with quite severe consequences for getting it wrong.

However, I truly believe that anyone with huge levels of drive, persistence, logic and above all ability to learn and adapt quickly can make significant progress in this sector, but like anything else what is worthwhile is not easy."

I ask Niraj what 'risk' factors does he see in the current market that other investors really do need to consider?

"Well it's fairly clear that the Bank of England base rate will rise although Mark Carney is hinting towards more of a slow (upward) growth path than some analysts expect. From the start I stress tested deals against higher interest rates and I went for HMOs partly because there is some inbuilt protection.

I am also building ample reserve funds so that in the worst case I can hopefully survive. I see property as a survival game, if you can stay liquid long enough then you can do very well in this business.

Aside from that, keeping a strict discipline to only do deals based on sound business principles is very important right now as getting into deals in London has become a little bit frustrating. It was very competitive and now it's ridiculously competitive so there is a I think I've done reasonably well, partly because I came into property with an experienced investor's mentality.

I only really care about the numbers and risk factors, I have no emotional involvement in any deal I've done. I talked myself out of a deal in New York last month because I wanted to do it more to feed my ego rather than because it was the right project."

What's next and why?

"I want to keep progressing the size and complexity of my deals, so the plan is to incrementally increase the GDV of each project. I'm not in a rush to do huge deals and still have a lot to learn.

I expect to be investing in and developing property for the rest of my life, either as a full time focus or to have one or two deals running in the background whilst I work on other projects. I have ambitions to grow a sizeable business within or related to the property sector, but I don't yet know what angle I will take.

Back in early-2013 I read a very interesting article in 'Property Investor News' magazine about an impressive London property developer who had also started out in Canary Wharf with HMOs. I've since met up with Martin Skinner quite regularly over the last 18 months, we've done some business together and recently he asked me to get more involved with his property business. It makes sense to get more exposure to the size and types of deals they are doing so I'm doing some interim work with Inspired Asset Management.

Otherwise I'm constantly looking to build partnerships with service providers and financiers, always looking for my next property deal and I'm also putting time into working out the next business to build!"

--

April 2024 footnote:

Since 2014 I've continued to buy, refurbish, operate and sell properties ranging from professional HMOs, student HMOs, single lets, joint ventures, refurbishments and commercial developments.

The principles covered in the interview above are still those I work to today.

In 2014 I co-founded the property technology pioneer CrowdProperty alongside Simon Zutshi, Mike Bristow and Andrew Hall. I remain a founder shareholder and customer.

Since 2017 I've been working on other businesses whilst running a number of property deals in the background, as well as lending to or investing in other people's deals.

Links: 1) Property Investor News magazine; 2) a link to the original interview.

Entrepreneurship, energy, freedom (no spam, unsubscribe anytime).